Commitment to Sustainable Practices

Explore the Foundations of Our Sustainability Strategy

Hexcel is leading the transition to more lightweight, fuel-efficient transportation. Lighter yet stronger than any comparable material in the world, Hexcel advanced composites are turning the dream of cleaner, efficient, and more sustainable flight and transportation into reality, today.

Meet the Governance Committee

-

Jeffrey C. Campbell

Retired Vice Chairman & Chief Financial Officer, American Express CompanyMr. Campbell is the former Vice Chairman and former Chief Financial Officer of the American Express Company, a global services company. Before joining American Express in 2013, Mr. Campbell was CFO of the McKesson Corporation, a leading healthcare services, information technology and distribution company. Prior to his time at McKesson, Mr. Campbell spent 13 years at AMR Corp and its principal subsidiary American Airlines, ultimately becoming the company’s CFO in 2002. He held a variety of financial and operations positions at American, including leading the company’s Europe, Middle East, and Africa operations while based in London. He began his professional career as a certified public accountant and management consultant with Deloitte, Haskins & Sells. Mr. Campbell has been a director of Aon plc since March 2018, and is the chair of its audit committee and a member of its executive, organization and compensation committees. Mr. Campbell has also been a director of Marathon Petroleum Company, since November 2024, and is a member of its audit committee and compensation and organizational development committee.

-

Cynthia M. Egnotovich

Retired President – Aerospace Systems Customer Service, United Technologies CorporationMs. Egnotovich served as President, Aerospace Systems Customer Service of United Technologies Corporation (“UTC”) from July 2012 to November 2013. Previously, Ms. Egnotovich served as Segment President, Nacelles and Interior Systems for Goodrich Corporation (which was acquired by UTC) from 2007 to 2012. Ms. Egnotovich joined Goodrich in 1986 and held leadership roles of increasing significance, including Segment President of Engine Systems, Segment President Electronic Systems and Segment President Engine & Safety Systems. Ms. Egnotovich served as a director of The Manitowoc Company from 2008 to 2016, where she was a member of its audit committee and served as the chair of its compensation committee. She also was a director at Welbilt from 2016 to 2022. In September 2022, she joined the board of Triumph Group, Inc and is a member of its audit and nominating, governance and sustainability committees.

-

Guy C. Hachey

Retired President and Chief Operating Officer, Bombardier Aerospace, Inc.Mr. Hachey served as the Chief Executive Officer and President of Bombardier Aerospace, Inc., an aircraft manufacturer, from May 2008 to July 2014. Prior to joining Bombardier in 2008, Mr. Hachey held numerous roles with Delphi Corporation, including the combined positions of Vice President, Delphi Corporation and President, Delphi Europe, Middle East, Africa and President, Delphi Europe, Middle East and Africa, as well as Executive Champion for Delphi’s global manufacturing operations. Mr. Hachey began his career with General Motors Corporation, where he held manufacturing and engineering leadership positions in Canada and the U.S. Mr. Hachey was a member of the board of directors of Meggitt PLC, a British company whose shares are listed on the London Stock Exchange, from 2019 until 2022.

-

Dr. Patricia A. Hubbard

Senior Vice President and Chief Technology Officer, Cabot CorporationDr. Hubbard is the Senior Vice President and Chief Technology Officer of Cabot Corporation, a specialty chemicals and performance materials company, a position she has held since February 2018. Prior to joining Cabot, Dr. Hubbard served as Vice President of R&D for the Label and Graphic Materials division in North America of Avery Dennison, an adhesive manufacturing company, from September 2016 to February 2018. Prior to Avery Dennison, she held the role of Vice President of R&D at Avient Corporation and held various R&D roles at General Electric. Dr. Hubbard previously served on the board of directors of NAATBatt International, which promotes the development and commercialization of electrochemical energy storage technology and the revitalization of advanced battery manufacturing in North America. She holds a doctorate in polymer science from the University of Akron and a degree in chemistry from Case Western Reserve University.

-

Gail E. Lehman

Executive Vice President, Chief Legal and Sustainability Officer, and SecretaryGail Lehman is Executive Vice President, Chief Legal and Sustainability Officer, and Secretary. She joined Hexcel in 2017 after working at Noranda Aluminum Holding Corporation where she served as Chief Administrative Officer, General Counsel & Corporate Secretary. Prior to Noranda, Gail was Vice President, General Counsel & Corporate Secretary at both Hawker Beechcraft Corporation and Covalence Specialty Materials Corporation. Earlier in her career, Gail held numerous roles as Assistant General Counsel and General Counsel at Honeywell International, supporting Treasury and Finance, Honeywell Fluorine Products, Engineered Plastics and Specialty Films, and environmental litigation and regulatory compliance. Gail began her career as an environmental litigation associate with Lowenstein Sandler. Gail has a degree in psychology from Rutgers College, a graduate degree in educational psychology from Rutgers Graduate School of Education, and a law degree with high honors from Rutgers University School of Law.

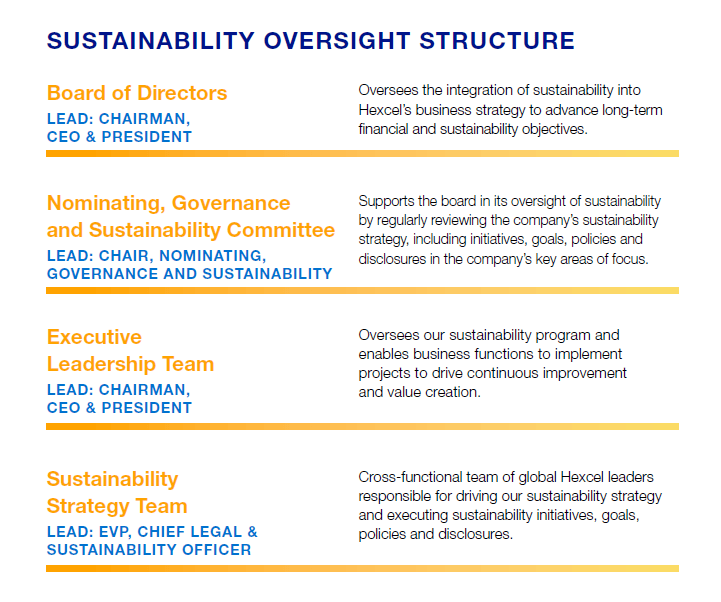

Sustainability Oversight Structure

Hexcel advanced composite materials play an essential role in enabling our customers to achieve their goals to optimize fuel consumption, lower emissions, reduce noise and help sustain the planet for generations to come. Each new generation of commercial aircraft has used increasing quantities of advanced composites to replace metals and reduce weight for more fuel-efficient aircraft with lower CO2 emissions.

Our culture is intentional and unique. We call it One Hexcel. One Hexcel captures how we work with one another, with a long-standing commitment to working collaboratively. Our success is dependent on what each person brings to the company. We value our people, develop talent, foster teamwork, and reward success.

In 2025 100% of our sites achieved ISO 45001 certification. Protecting the health and safety of our workers is a top priority, and we are committed to providing a safe working environment. We use worker inputs, incident data and trends, and leading indicators to create systemic improvement plans to reduce hazardous conditions and at-risk behaviors. We also use employee feedback to best serve our workforce. Members of our Human Resources department regularly review benefits to ensure we are supporting the well-being of our employees and their families.

We provide recurring training on relevant ethics, compliance, and environmental health and safety topics as well other pertinent topics and laws affecting our global business. In addition, we require targeted groups of employees to complete online training to reinforce their understanding of specific values, laws or regulations that are highly relevant to their roles, such as anti-corruption, antitrust/competition, harassment/discrimination, conflicts of interest and trade compliance.

We recognize our responsibility to help make the world a better place for us all through both charitable giving and volunteerism. Every day, Hexcel employees live our Values and fulfill our Purpose as we build houses for low-income families, run races to fund cancer research, cook meals for the hungry, provide needy children with school supplies, and so much more. Each year, every site is challenged to donate at least $50 per employee to local charitable organizations. In addition, sites donate thousands of volunteer hours to support their communities. These decisions to donate time and money are recommended to local leadership by employees who comprise Hexcel Community Involvement Councils, established at every location to foster deep relationships within the communications where we do business.

Read more about our recent collaboration with the Auvergne Rhone Alpes (AURA) Handisport League.

Student Research Support

Hexcel is proud to support the various colleges and universities worldwide from which we recruit our best talent by providing limited quantities of our raw material products such as carbon fiber , reinforced fabric, honeycomb, resins and adhesives in support of research and other student-led projects.

Our Hexcel Foundation is committed to investing in local communities around the world by supporting organizations with a global focus on STEM education, health, hunger and homelessness. Reflecting the company’s commitment to investing in our communities as part of our 2030 sustainability goals, grants were made to organizations such as:

- The Smithsonian National Air and Space Museum for its STEM in 30 program, an Emmy-nominated webcast series that engages middle school students across the globe in Science, Technology, Engineering, and Math (STEM) topics in just 30 minutes. Museum curators, astronauts, and experts in various STEM fields connect to classrooms with real-world, relevant content to show students that science extends beyond the walls of their school. Hexcel has sponsored four programs — Buzz the Tower: Bees and Aerospace, Dream Jobs: Careers in Aerospace, From Hubble to Webb: Observatories in Space, and Written in the Sky: The History & Future of Aerial Advertisement.

- The Cancer Research Institute which works with a global network of leading researchers, supporters, patients and advocates to fund the most promising clinical and laboratory research in fighting cancer through immunotherapy in hopes of harnessing the power of our immune systems to control and potentially cure all types of cancer.

- Convoy of Hope for its Children’s Feeding Initiative, providing nutritious meals and monitoring the health and growth of children in multiple countries around the world. The Initiative also works to provide clean and safe water and healthy living environments.

Hexcel Foundation Scholarship Program

Hexcel awards renewable scholarships of $2,000 to $5,000 a year to the children of Hexcel employees in the U.S. who plan to pursue post-secondary education in college and vocational programs at any accredited post-secondary institution of the student’s choice. Since 1987, scholarships totaling more than $2 million have been awarded.

Educational Gift Matching Program

Hexcel matches cash contributions made by employees, dollar-for-dollar, from a $25 minimum to a $500 maximum per employee in any calendar year to accredited nonprofit institutions of higher learning in the U.S.

Responsible governance is the cornerstone of everything we do at Hexcel. We have implemented a robust ethics and compliance program overseen by our board of directors to ensure compliance with applicable laws and regulations governing ethical business practices. The Hexcel Business Code of Conduct establishes a comprehensive framework for compliance to promote accountability, and 100% of Hexcel officers, directors and salaried employees are required to certify compliance with the Code of Business Conduct annually.

At Hexcel, we operate in accordance with the highest ethical and legal standards, and we strongly believe in upholding human rights principles and fair labor practices within our organization and our supply chain. We require 100% of our critical direct suppliers to commit, through our Supplier Code of Conduct, to comply with all applicable laws where they do business, including laws related to equal opportunity and non-discrimination, and laws prohibiting forced labor, human trafficking and slavery. Our Supplier Code of Conduct is continuously reviewed and enhanced, such as the addition of strengthened sustainability and cybersecurity requirements.

At Hexcel, we are committed to the security of our products and services, the protection of employee, customer and Hexcel data and the safeguarding of our manufacturing capability. We leverage the latest encryption configurations and cybertechnologies, and continuously monitor and audit our information technology and data assets to detect any anomalies and to respond quickly to threats that may arise. Our senior executive leadership are directly involved through a formalized response team that regularly participates in tabletop exercises simulating cyberattacks. Our board actively oversees our cybersecurity practices, with our Chief Information Officer regularly reporting directly to our board.

At Hexcel, we recognize our responsibility to help protect the planet and its resources. As such, we are committed to minimizing our impact by reducing our greenhouse gas emissions and waste to landfill, among other opportunities to improve sustainability within our operations. Below are several projects helping us to achieve our 2030 targets.

We focus on process improvements to facilitate standardization and efficient production, which reduces material consumption and waste and have undertaken a number of other initiatives to encourage environmentally friendly work practices, such as recycling and reuse.

Hexcel provides the broadest product portfolio of lightweight composite solutions for the aerospace industry, and we target select performance-oriented industrial markets. By lightweighting aircraft and other forms of transportation, fuel consumption is reduced leading to lower emissions. Hexcel composite solutions contribute to reducing fuel consumption by 25% on the composite rich Airbus A350 and Boeing 787 as compared to prior generation aircraft.

We propel the future of flight and transportation through excellence in providing innovative, high-performance material solutions that are lighter, stronger and tougher — helping create a better world for us all.

Our policies and other resources are designed to consolidate and summarize our work on ESG topics that are important to our business and stakeholders.

Latest Updates in Innovation

Hexcel Reports 2025 Fourth Quarter and Full Year Results

STAMFORD, Conn.–(BUSINESS WIRE)– Hexcel Corporation (NYSE: HXL): -Q4 2025 Sal

Hexcel to Showcase Lightweight Advanced Composite Material Solutions at WINGS India 2026 – 28-31 January – Hyderabad – India

Hexcel Corporation (NYSE: HXL), a global leader in advanced composite technologies for aer